All Categories

Featured

Table of Contents

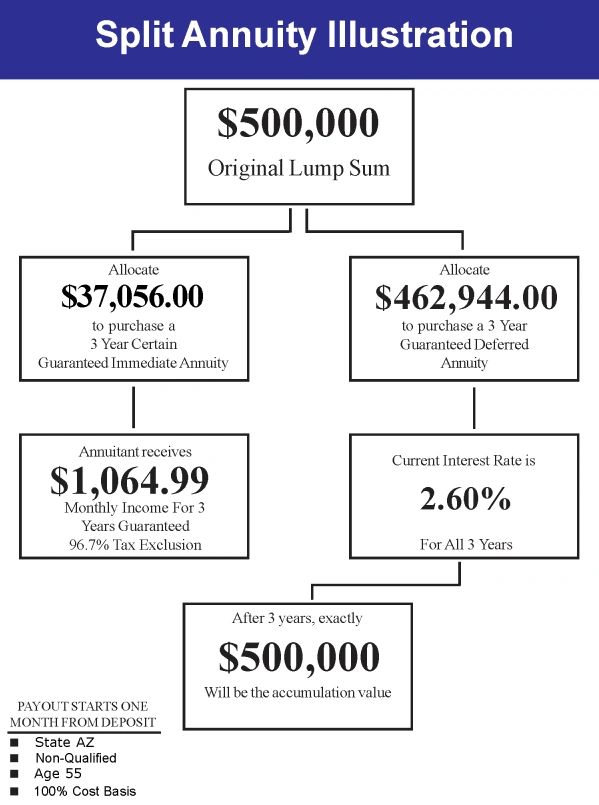

The inquirer stands for a client that was a complainant in an accident issue that the inquirer picked behalf of this complainant. The offenders insurer consented to pay the plaintiff $500,000 in a structured negotiation that needs it to purchase an annuity on which the plaintiff will certainly be detailed as the payee.

The life insurance company issuing the annuity is an accredited life insurance company in New York State. N.Y. Ins.

N.Y. Ins.

N.Y. Ins. The Department has actually reasoned that an annuitant is the possessor of the fundamental right granted under an annuity contract and specified that ". NY General Advise Opinion 5-1-96; NY General Counsel Viewpoint 6-2-95.

Annuity Products

Although the owner of the annuity is a Massachusetts corporation, the desired beneficiary and payee is a resident of New York State. Since the above specified purpose of Write-up 77, which is to be liberally construed, is to safeguard payees of annuity agreements, the payee would be protected by The Life insurance policy Company Guaranty Corporation of New York City.

* A prompt annuity will certainly not have a build-up phase. Variable annuities provided by Safety Life insurance policy Company (PLICO) Nashville, TN, in all states except New York and in New York by Safety Life & Annuity Insurer (PLAIC), Birmingham, AL. Stocks supplied by Investment Distributors, Inc. (IDI). IDI is the major underwriter for registered insurance coverage items provided by PLICO and PLAICO, its associates.

Best Annuities For Income

Investors must meticulously consider the financial investment purposes, risks, charges and expenses of a variable annuity and the underlying financial investment alternatives before investing. This and other info is included in the prospectuses for a variable annuity and its hidden financial investment options. Syllabus might be gotten by contacting PLICO at 800.265.1545. why buy annuities. An indexed annuity is not an investment in an index, is not a security or supply market investment and does not take part in any kind of supply or equity financial investments.

The term can be three years, 5 years, 10 years or any kind of number of years in between. A MYGA works by locking up a lump amount of money to permit it to accumulate rate of interest. If you need to take out money from an annuity before the buildup duration mores than, you might have to pay costs called surrender fees.

Annuities Types Explained

If you choose to restore the agreement, the interest rate might differ from the one you had actually initially agreed to. Due to the fact that interest prices are set by insurance policy firms that sell annuities, it's vital to do your study prior to signing an agreement.

They can defer their taxes while still employed and not in need of additional taxable earnings. Offered the existing high rate of interest rates, MYGA has become a substantial element of retirement financial planning - annuitization phase. With the possibility of rates of interest declines, the fixed-rate nature of MYGA for a set variety of years is extremely appealing to my clients

MYGA rates are usually higher than CD rates, and they are tax deferred which additionally boosts their return. A contract with even more restricting withdrawal stipulations may have higher prices.

In my point of view, Claims Paying Ability of the provider is where you base it. You can look at the state warranty fund if you desire to, however bear in mind, the annuity mafia is watching.

They recognize that when they put their cash in an annuity of any kind of type, the firm is going to back up the case, and the market is managing that. Are annuities guaranteed? Yeah, they are. In my point of view, they're secure, and you should go into them considering each carrier with self-confidence.

If I placed a referral in front of you, I'm also putting my certificate on the line. I'm really confident when I placed something in front of you when we chat on the phone. That doesn't indicate you have to take it.

Annuities Near Me

We have the Claims Paying Capacity of the service provider, the state warranty fund, and my friends, that are unknown, that are circling around with the annuity mafia. That's a factual response of someone that's been doing it for a very, very lengthy time, and that is that a person? Stan The Annuity Man.

People typically buy annuities to have a retired life revenue or to construct financial savings for another purpose. You can purchase an annuity from a licensed life insurance policy representative, insurance policy company, financial coordinator, or broker. You ought to talk with an economic consultant regarding your needs and objectives prior to you acquire an annuity.

Best Deferred Income Annuity

The difference in between the two is when annuity repayments start. enable you to save cash for retired life or various other reasons. You don't have to pay taxes on your profits, or payments if your annuity is a private retired life account (IRA), until you take out the profits. enable you to create an income stream.

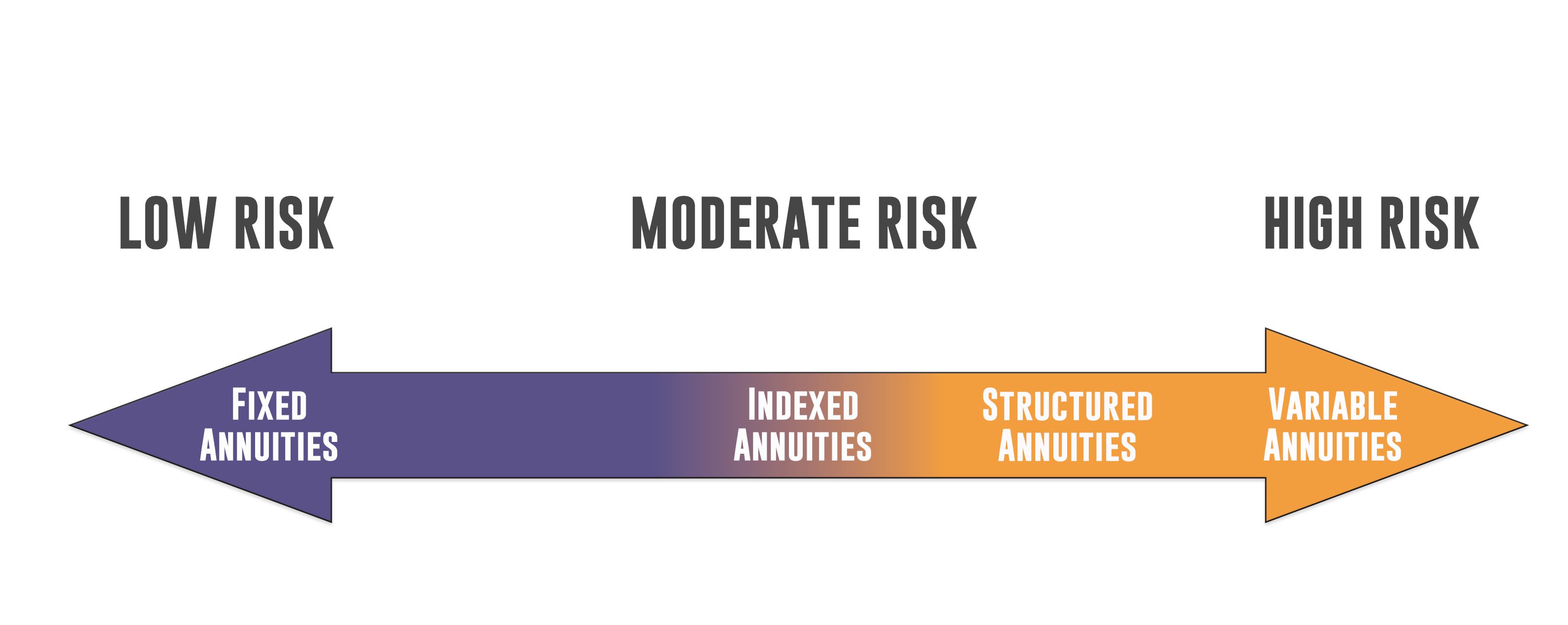

Deferred and immediate annuities use a number of choices you can pick from. The choices give various degrees of possible threat and return: are guaranteed to gain a minimal interest rate.

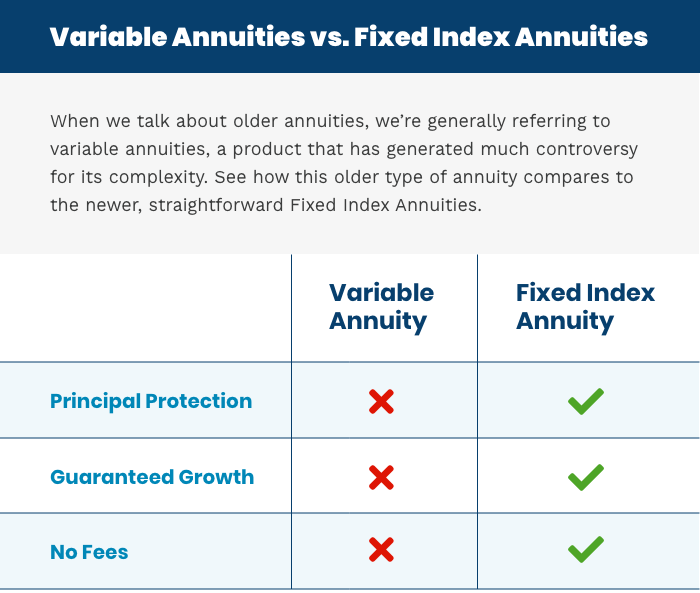

Variable annuities are greater threat since there's a chance you can lose some or all of your cash. Fixed annuities aren't as dangerous as variable annuities since the financial investment risk is with the insurance policy business, not you.

Benefits Of Variable Annuities

If efficiency is low, the insurance policy business bears the loss. Set annuities guarantee a minimal rate of interest, normally between 1% and 3%. The firm may pay a greater interest rate than the ensured rate of interest. The insurance business identifies the interest prices, which can transform regular monthly, quarterly, semiannually, or yearly.

Index-linked annuities reveal gains or losses based upon returns in indexes. Index-linked annuities are extra intricate than dealt with delayed annuities. It is essential that you comprehend the attributes of the annuity you're taking into consideration and what they mean. Both legal functions that influence the quantity of rate of interest credited to an index-linked annuity the most are the indexing method and the involvement rate.

Each depends on the index term, which is when the business computes the rate of interest and credits it to your annuity. The identifies just how much of the increase in the index will be made use of to compute the index-linked passion. Various other crucial functions of indexed annuities consist of: Some annuities cap the index-linked rates of interest.

Not all annuities have a floor. All dealt with annuities have a minimum guaranteed value.

Various other annuities pay compound rate of interest throughout a term. Substance interest is passion made on the money you conserved and the rate of interest you gain.

Immediate Pay Annuity Calculator

If you take out all your money before the end of the term, some annuities won't attribute the index-linked interest. Some annuities might attribute just part of the rate of interest.

This is since you bear the financial investment danger instead of the insurance provider. Your representative or economic consultant can aid you determine whether a variable annuity is best for you. The Securities and Exchange Compensation identifies variable annuities as safeties due to the fact that the performance is acquired from supplies, bonds, and various other investments.

Annuity Rates Fixed

An annuity contract has two stages: a build-up stage and a payout phase. You have several options on exactly how you add to an annuity, depending on the annuity you buy: allow you to select the time and amount of the payment.

The Internal Revenue Solution (IRS) controls the tax of annuities. If you withdraw your earnings prior to age 59, you will most likely have to pay a 10% very early withdrawal penalty in enhancement to the taxes you owe on the rate of interest gained.

After the accumulation stage finishes, an annuity enters its payout stage. This is occasionally called the annuitization stage. There are numerous alternatives for getting settlements from your annuity: Your company pays you a taken care of quantity for the time specified in the agreement. The company makes settlements to you for as long as you live, yet there are not any repayments to your heirs after you pass away.

Several annuities charge a fine if you take out cash prior to the payout stage. This fine, called a surrender charge, is commonly highest in the very early years of the annuity. The charge is commonly a percentage of the taken out money, and normally begins at about 10% and goes down every year up until the surrender period is over.

Table of Contents

Latest Posts

Breaking Down Deferred Annuity Vs Variable Annuity Everything You Need to Know About Variable Annuity Vs Fixed Indexed Annuity Defining Fixed Index Annuity Vs Variable Annuities Benefits of Annuities

Understanding Fixed Income Annuity Vs Variable Annuity A Comprehensive Guide to Variable Vs Fixed Annuities Breaking Down the Basics of Variable Annuity Vs Fixed Annuity Benefits of Choosing the Right

Highlighting the Key Features of Long-Term Investments A Closer Look at Fixed Vs Variable Annuity Pros Cons Breaking Down the Basics of Annuity Fixed Vs Variable Advantages and Disadvantages of Variab

More

Latest Posts